贝索斯又一次大手笔抛售亚马逊

本周,贝索斯卖出了30亿美元(约合200亿人民币)的亚马逊股票。今年以来,贝索斯已三次集中抛售,套现超百亿美元(约合665亿人民币),比19年的套现规模高出两倍。

近期,看空美国大型科技股的声音越来越多。小摩也表示,无论谁赢得大选。科技股都不会再领跑。贝索斯这一套现,分析师们又多了一个新的看空理由。

Bezos is selling Amazon again

This week, Bezos sold $3 billion in Amazon shares. Since the beginning of this year, Bezos has sold three times, cashing in more than 10 billion U.S. dollars (about 66.5 billion yuan), twice the scale of 19 years' cash out.

Recently, there have been more and more bearish voices about large US technology stocks. Xiao Mo also said that no matter who wins the election. Technology stocks will no longer lead. Bezos this arbitrage, analysts have a new bearish reason.

贝索斯再抛售200亿亚马逊股票 今年已套现665亿

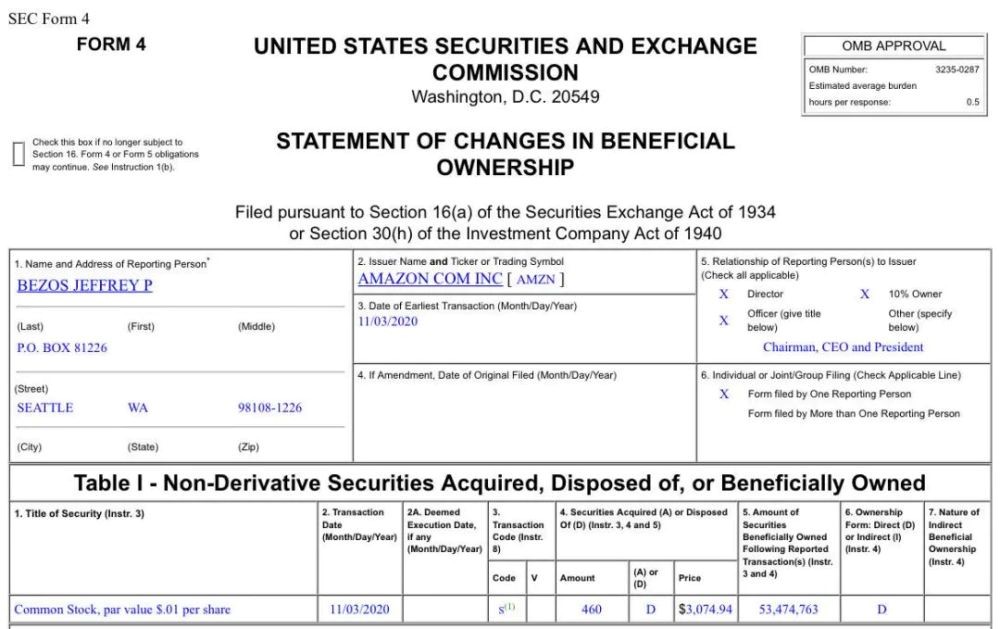

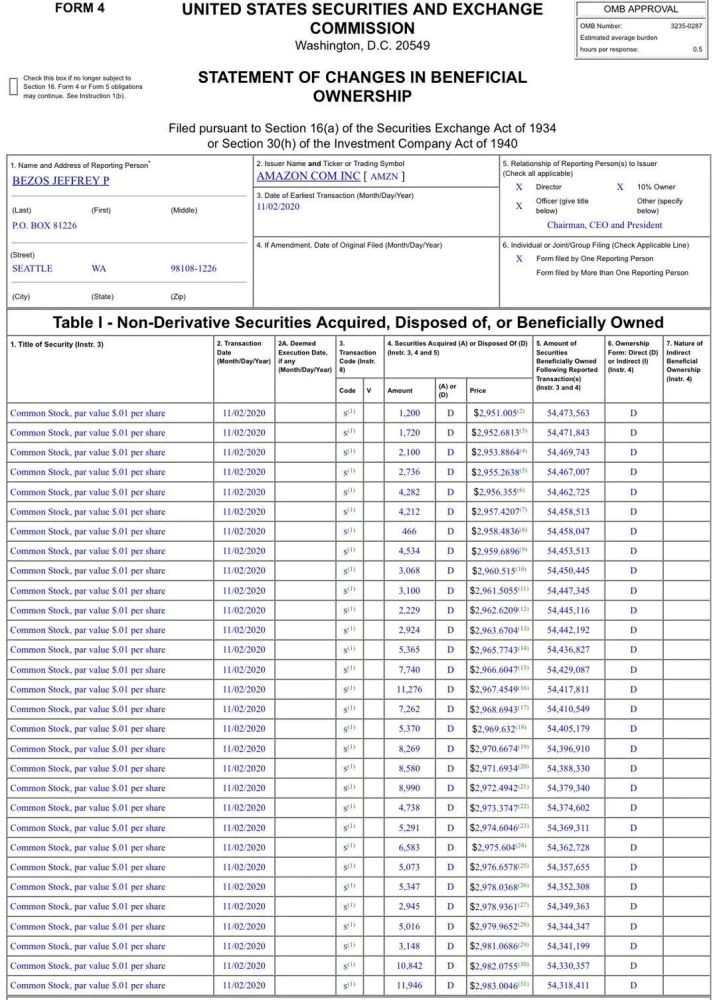

当地时间本周三,亚马逊发布多份持股变动声明。据上述声明,本周一和周二(美国大选日),外媒报道,亚马逊创始人兼首席执行官杰夫•贝佐斯卖出了100万股、价值30亿美元(约合人民币200亿)的亚马逊公司股票。

Bezos sells another 20 billion Amazon shares

This year, 66.5 billion yuan has been realized

Local time this Wednesday, Amazon issued a number of changes in shareholding statements. According to the statement, foreign media reported on Monday and Tuesday (US election day) that Amazon founder and CEO Jeff Bezos sold 1 million shares of Amazon shares worth $3 billion.

SEC文件还显示,贝索斯本周抛售的股票占其所持股份的1.8%,卖出价格在每股2950美元到3075美元之间。

本周的抛售使得贝索斯在2020年的总套现额超过100亿美元(约合人民币665亿)。

今年以来,受益于疫情间的网购需求暴涨,亚马逊已涨超75%。近两个月,亚马逊股价上行趋势减弱,整体呈震荡走势。

The SEC also showed that Bezos sold 1.8 percent of its shares this week, selling between $2950 and $3075 a share.

This week's sell-off has made Bezos' total cash carry over $10billion (66.5 billion) in 2020.

This year, thanks to the surge in online shopping demand between the epidemic, Amazon has risen more than 75%. In the past two months, the upward trend of Amazon's stock price has weakened, showing a volatile trend as a whole.

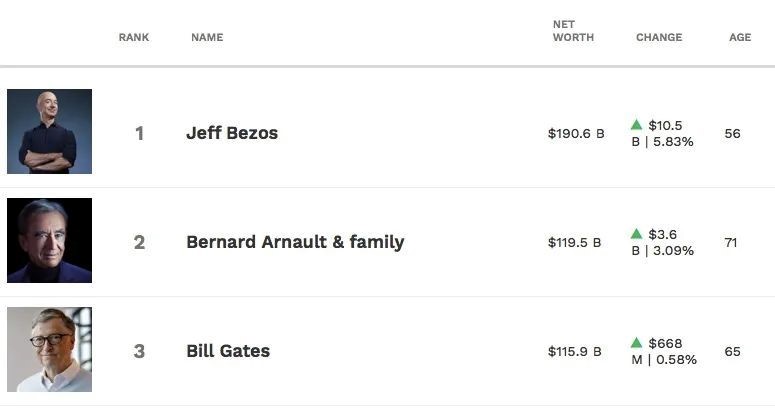

在今年累计抛售超过100亿美元的股票后,贝索斯的持股比例降到10.6%,持股价值约1700亿美元,贝索斯本人也依然以1906亿美元的身家稳坐世界首富的宝座。

After selling more than $10 billion of shares this year, Bezos's shareholding ratio has dropped to 10.6%, with a holding value of about 170 billion US dollars. Bezos himself is still the richest man in the world with his wealth of 190.6 billion US dollars.

今年已套现百亿美元

超出19年两倍,超计划金额九倍

本周的集中是贝索斯今年以来第三次集中抛售亚马逊股票。

今年年初,贝索斯卖出了价值超过40亿美元的亚马逊股票。今年8月,贝索斯出售了价值31亿美元的亚马逊股票。

其实,贝索斯早就把自己“持续”抛售亚马逊股票的意向告诉给市场了,但如此大规模的抛售依然超出预期。

2017年,贝索斯发表声明称,计划每年抛售价值约10亿美元的亚马逊股票,以资助自己的Blue Origin火箭公司。贝索斯曾表示,“部署这么多财产,我唯一能想到的途径就是将我的亚马逊收益转换到太空旅行方面。”

而贝索斯今年套现的金额远超“10美元”的原计划9倍。

公开信息显示, Blue Origin是贝索斯旗下的一家商业火箭公司,于2000年成立,是Nasa的供应商之一,与特斯拉创始人马斯克旗下的Space X公司是竞争对手。

不仅远超向公众宣布的抛售计划,贝索斯2020年套现的金额还远超其2019年抛售的金额。

据Yahoo财经,2019年,贝索斯共套现了28亿美元的亚马逊股票。

据悉,贝佐斯于今年2月启动了一项100亿美元的地球基金,以应对气候变化的影响,该基金将向科学家,激进主义者和其他组织发放赠款。

Ten billion US dollars have been realized this year

Twice over 19 years and nine times more than planned

This week's focus is Bezos' third concentrated sell-off of Amazon shares this year. Earlier this year, Bezos sold more than $4 billion in Amazon shares. In August, Bezos sold $3.1 billion of Amazon shares.

In fact, Bezos has long told the market of his intention to "continue" selling Amazon shares, but such a large-scale sell-off is still beyond expectations. In 2017, Bezos announced in a statement that it plans to sell Amazon shares worth about $1 billion a year to fund its own blue origin Rocket Company. Bezos once said, "the only way I can think of deploying so much property is to convert my Amazon earnings into space travel." And Bezos's cash out amount this year is far more than the original plan of "10 dollars". According to public information, blue origin, a commercial Rocket Company owned by Bezos, was established in 2000 and is one of the suppliers of NASA. It is a competitor to space X, a company owned by Tesla founder musk.

Not only is it far more than the sell-off plan announced to the public, but Bezos's cash out in 2020 is also far more than its selling amount in 2019.

According to Yahoo Finance, Bezos cashed out $2.8 billion of Amazon stock in 2019. It is reported that Bezos launched a $10 billion earth fund in February to address the impact of climate change, which will grant grants to scientists, activists and other organizations.

美国大型科技股见顶了?

分析师:估值已高到疯狂

贝索斯在大选之际大幅抛售亚马逊股票,为看衰科技股的投资者又增添了一个新的看空理由。

实际上,华尔街看空科技股的声音近期越来越多。

近日,对冲基金绿光资本(Greenlight Capital)创始人David Einhorn在一份报告中写道,美股科技股正处于一个巨大的泡沫中,基于这一判断,他增加了对科技股做空头寸的配置。

本周,Webull首席执行官Anthony Denier表示:几位投资银行分析师声称“在疫情期间科技股的估值已高得疯狂”,再次呼吁投资者降低面向科技股的风险敞口,这导致科技股在周一午后承压。但他也承认,科技股仍是散户的最爱。

在多支大型科技股发布最新季报后,瑞银资产管理的多资产战略负责人Evan Brown表示:“正如我们从这些大公司财报引发的反应中看到的那样,超出预期也不足以让这个市场满意,我认为这可以说明其中很多股票的估值已经到顶了。”

Big tech stocks in the US peaked?

Analysts: valuations are crazy

Bezos's sharp sell-off of Amazon shares in the run-up to the general election has added another reason for bearish tech investors.

In fact, there have been more and more bearish voices on Wall Street recently. Recently, David Einhorn, founder of hedge fund Greenlight Capital, wrote in a report that US technology stocks are in a huge bubble. Based on this judgment, he increased the allocation of technology stocks.

This week, Anthony denier, Webull's chief executive, said: several investment bank analysts claimed that "the valuations of technology stocks were crazy during the outbreak" and renewed their call for investors to reduce their exposure to technology stocks, which put pressure on technology stocks on Monday afternoon. But he also admits that technology stocks are still retail favorites.

"As we can see from the reaction to the earnings reports of these big companies, exceeding expectations is not enough to satisfy the market, and I think it shows that valuations of many of these stocks have peaked," said Evan brown, head of multi asset strategy at UBS asset management after the latest quarterly results of several large technology stocks

“坚定拥护者”也转向了

小摩两年来首次下调美股科技股评级

即使科技股在大选结果即将出炉之际大涨,小摩依然不认可科技股将继续领跑。

摩根大通策略师Mislav Matejka表示,将美股科技股的评级从“增持”下调至“中性。此前两年,摩根大通一直看好科技股。

Matejka预测,无论谁赢得大选,市场领跑者都将发生变化。

Matejka并不认为科技股的盈利状况将迅速恶化,他称,“我们仍然相信,通过强劲的资产负债表、大规模回购、结构性利好因素和盈利表现,科技股的基本面是有利的,但相对领先的表现可能会开始减弱。”

摩根大通分析师认为,科技股优于银行股这种情况到2021年可能会有所改变。在下调科技股评级的同时,摩根大通将银行股的评级从“中性”上调至“增持”,将保险股的评级从“中性”上调至“增持”。

The "staunch supporters" have also turned

Xiaomo downgrades technology stocks in the US for the first time in two years

Even if technology stocks soared in the run-up to the election results, Xiaomo still does not accept that technology stocks will continue to lead.

Mislav matejka, a strategist at JPMorgan, said the rating of US technology stocks was lowered from "overweight" to "neutral". JPMorgan had been bullish on technology stocks for the past two years.

Matejka predicts that market leaders will change no matter who wins the election. Matejka does not believe that the profitability of technology stocks will deteriorate rapidly, he said. "We still believe that the fundamentals of technology stocks are favorable through strong balance sheet, large-scale repurchase, structural favorable factors and earnings performance, but the relatively leading performance may begin to weaken."

JPMorgan analysts believe that technology stocks outperform bank stocks, which may change by 2021. At the same time, JPMorgan raised the rating of bank stocks from "neutral" to "overweight" and insurance stocks from "neutral" to "overweight".